estate tax exemption 2022 married couple

Many married couples fall into the portability trap They fail to file an IRS form after one spouse dies and accidentally forfeit a massive. There is no estate tax in Colorado.

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

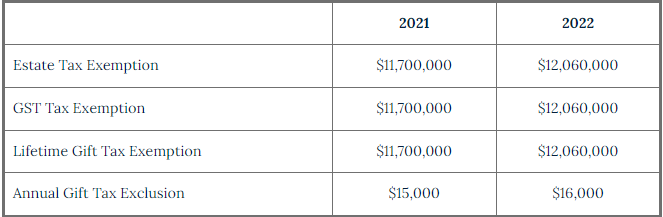

The federal estate tax exemption is 1170 million in 2021 going up to 1206 million in 2022.

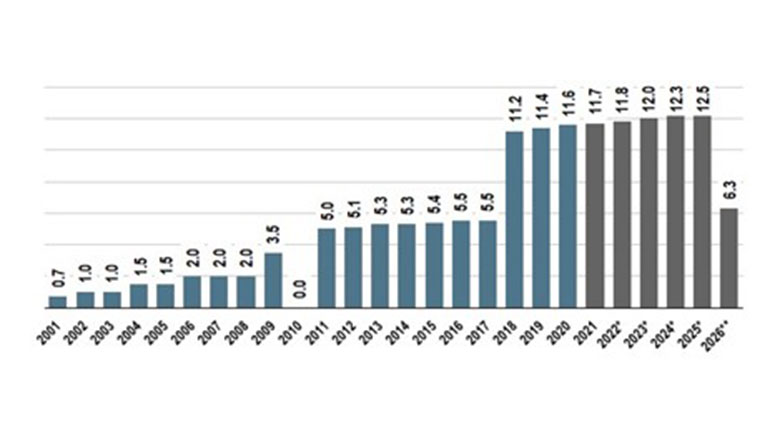

. This all-time high exemption limit is unlikely to last. Heres a look at how this exemption has changed over the years. This increase means that a married couple can shield a.

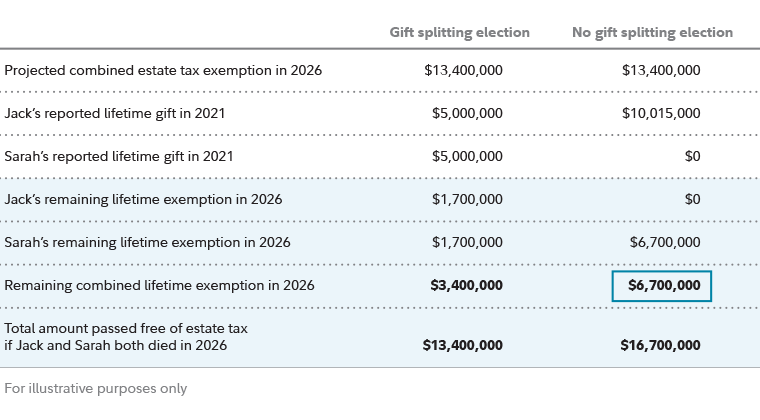

This article discusses some strategies that married taxpayers can use to manage their estate tax liability by creating certain types of trusts. This means that by taking certain legal steps a couple can protect up to 2412 million from estate taxes. Is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022.

Arizona follows the equation for Federal capital gains on a home sale. What Is The New Estate Tax Exemption For. The AMT offers a much higher exemption than the traditional tax code which is designed to avoid middle-class taxpayers from being hit by the AMT.

However if an estate is worth more than the federal estate tax exemption. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. For single taxpayers and married individuals filing separately the standard deduction rises to 12950 for 2022 up 400 and for heads of households the standard deduction will be 19400 for tax year 2022 up 600.

Each year the federal estate tax exemption changes to reflect inflation in the US economy. As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in 2021. As a result their son Jimmy will owe 0 in estate tax.

This means that if you pass away in 2022 and your estate is valued at this amount or more it will be subject to taxes. Colorado 2 withholding form and instructions. This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of 5450000.

As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021. The 2022 exemption is the largest in history but it wont last. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

The old law provided a 125000 one time tax free exclusion on profits for home sellers 55 or older. The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022. This means that a married couple will have 2412 million.

The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. U S Inflation 2022 The Clashing Forces That Will Drive Consumer Prices Bloomberg.

1 Key Takeaways The federal estate tax exemption for 2022 is 1206 million. Estate tax exemption 2022 inflation adjustment Sunday April 17 2022 For married couples the exclusion is now 24120000 million. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple can shield 2412 million.

The exemption can be applied against any gift tax that would otherwise be applicable to gifts made during life. Due to inflation the estate tax exemption has risen this year to 126 million dollars. It is portable between spouses.

During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for individuals and 2412 million for married couples in. The exclusion amount is for 2022 is 1206 million. This means that with the right legal steps a married couples estate exemption can be doubled when the second spouse dies.

Exemption Amounts 118100 Married or Surviving Spouses 75900 Unmarried Individuals 59050 Married Filing Separately 26500 Estates and Trusts Exemption Phaseouts Begin. On the federal level the estate tax exemption is portable between spouses. The unified estate and gift tax exemption is the maximum amount a person can give during life or transfer from an estate at death without paying gift or estate taxes.

A married couple has a combined exemption for 2022 of 2412 million 234 million for 2021. This means that an individual can leave 1206 million and a married couple can leave 2412 million dollars to their heirs or beneficiaries without paying any federal estate tax. For 2021 the exemption amount was set at 117 million dollars for individuals and double that amount for married couples.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. In 2021 its 117 million and in 2022 it increases to 1206 million for single filers and 2412 million for married couples. For 2021 this amount is 117 million or 234 million for married couples.

Since the exemption is so high most people dont pay estate taxes. The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million today. Federal Estate Tax Exemption.

The 2021 standard deduction is 12550 for single taxpayers or married filing separately. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. This increase means that a married couple can shield a total of 2412 million without having to pay any federal estate or gift tax.

2 days agoWhen Jane dies in 2026 shes got her own 6 million exemption plus Jeds 1206 million exemption which totals 186 million in exemptions. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. Estimated tax payments are.

The estate tax exemption. The federal estate tax exemption changes annually based on inflation.

What Is A Homestead Exemption And How Does It Work Lendingtree

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

How Your Estate Is Taxed Or Not

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Investment Partnership Agreement Template Sponsorship Letter Agreement Investing

Warshaw Burstein Llp 2022 Trust And Estates Updates

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Estate Planning Strategies For Gift Splitting Fidelity

Break Free From Debt In 2022 Break Free Debt Learning

Investment Partnership Agreement Template Sponsorship Letter Agreement Investing

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Changes To 2022 Federal Transfer Tax Exemptions Lexology

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

What Is The Future Of The Estate Tax Exemption Phelps Laclair

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt