is oregon 529 college savings plan tax deductible

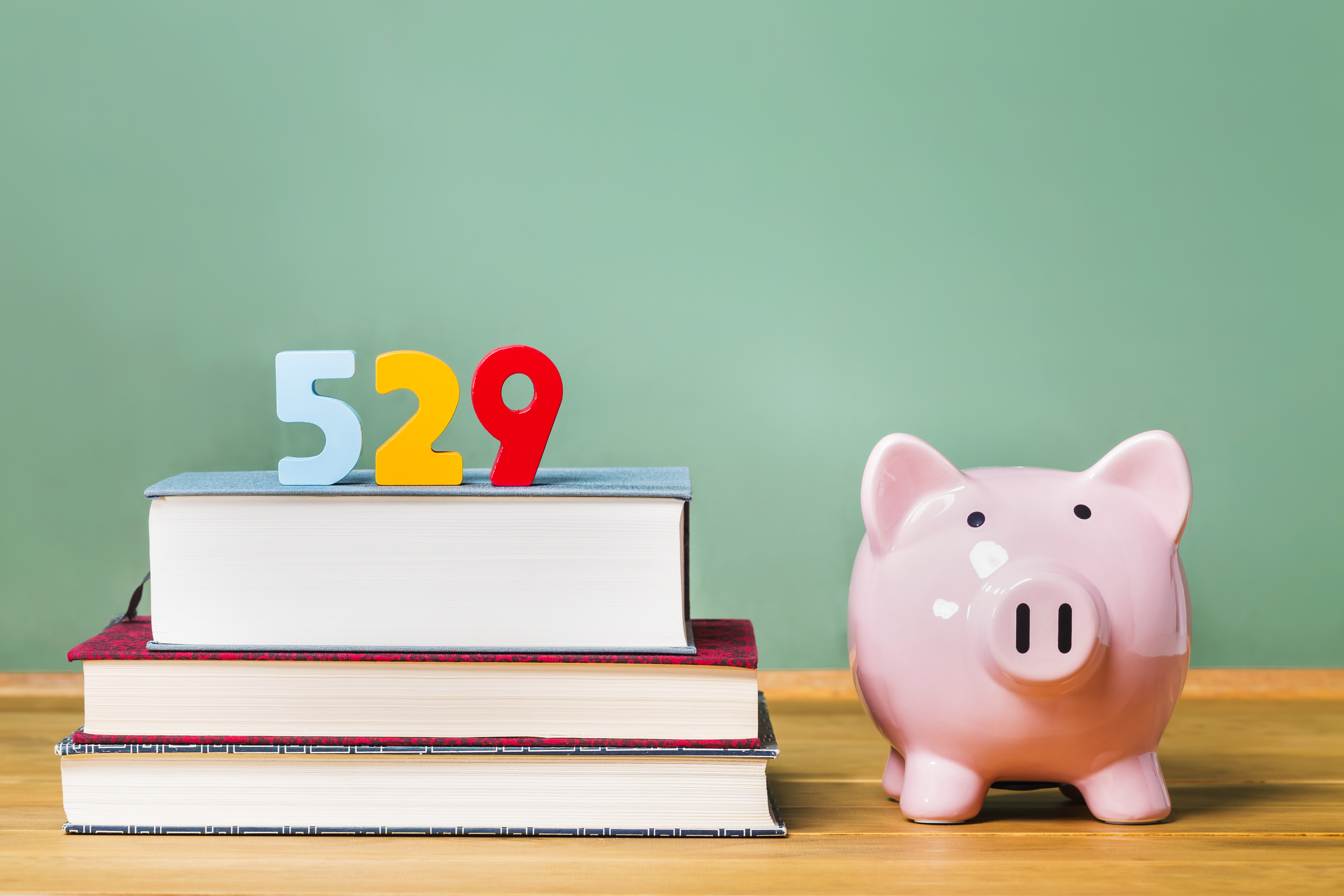

For example in 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan. Oregon families can take tax credits worth up to 300.

10 Things Every Colorado Family Should Know About College Savings

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

. The benefit of contributing to an Oregon College Savings Plan account is that your account earnings have the opportunity to grow tax-free and so long as the money in your. On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads. People who put money into a 529 account can deduct that contribution from their taxable state income up to 4660 in 2017 for married.

Oregon has an additional incentive. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon. Certificate of Deposits CDs.

The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300. The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents. You can deduct up to a maximum.

When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from. But only on contributions made prior to December 31 2019. Tax Benefits of the Oregon 529 Plan.

In 2021 529 contributions up to 15000 for individuals or 30000 for married couples filing jointly will. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

You do not need to be the owner of the account to contribute and claim the tax credit. The credit replaces the current tax deduction on January 1 2020. 529 Savings Plan vs.

A 529 plan can be a great alternative to a private student loan. So what starts small grows over time. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit.

The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan.

When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings. State tax deduction or credit for contributions.

Families who invest in 529 plans may be eligible for tax deductions. At least 30 states provide a tax deduction for 529 contributions but the rules for each plan differ. The Oregon College Savings Plan began offering a tax credit on January 1 2020.

Report 529 plan contributions above 15000 on your tax return. What Are The Federal And State Tax Advantages Of. The tax credit goes into effect on January 1 2020 and provides the same maximum credit to all Oregonians who are saving for college community college trade school or any other post.

This article will explain the tax deduction rules for 529 plans for current and future investors. Tax savings is one of the big benefits of using a 529 plan to save for college. On a federal-level there is no tax savings for contributions but qualified.

Oregon 529 Plan Tax Information. You may carry forward. Oregon taxpayers are eligible to receive a state tax credit for contributions to accounts of up to 150 300 if filing jointly.

Roth IRA for College. And unlike other investment.

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

529 College Savings Plans The Basics 529 College Savings Plan Savings Plan Saving For College

Pin On 529 College Savings Plan Board 529 Plans

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Michigan Education Savings Program Mesp Saving For College College Savings Plans 529 Plan

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Able Infographic By Oregon How To Plan Life Experiences Better Life

529 College Savings Plan Day Becker Capital Management Inc

529 Plans The Ultimate Guide To College Savings Plans

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

3 Reasons To Stash Your Cash In A 529 Instead Of A Regular Savings Account

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

Kiplinger S Picks Saving For College College Savings Plans 529 College Savings Plan

Oregon 529 Plan And College Savings Options Or College Savings Plan

Tax Benefits Oregon College Savings Plan

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Everything You Need To Know About 529 College Savings Plans In 2021

Saving For College The Oregon College Savings Plan The H Group Salem Oregon